TOPICS & NEWS

(JA) オフバランス化の問題点

Sorry, this entry is only available in JA.

TOPICS & NEWS

2022.11.01

(JA) Googleの進出で、『DC銀座』として更に加熱する千葉県印西市

Sorry, this entry is only available in JA.

TOPICS & NEWS

2022.11.01

(JA) オフバランス化とは何か?注目される理由を解説します。

Sorry, this entry is only available in JA.

TOPICS & NEWS

2022.09.29

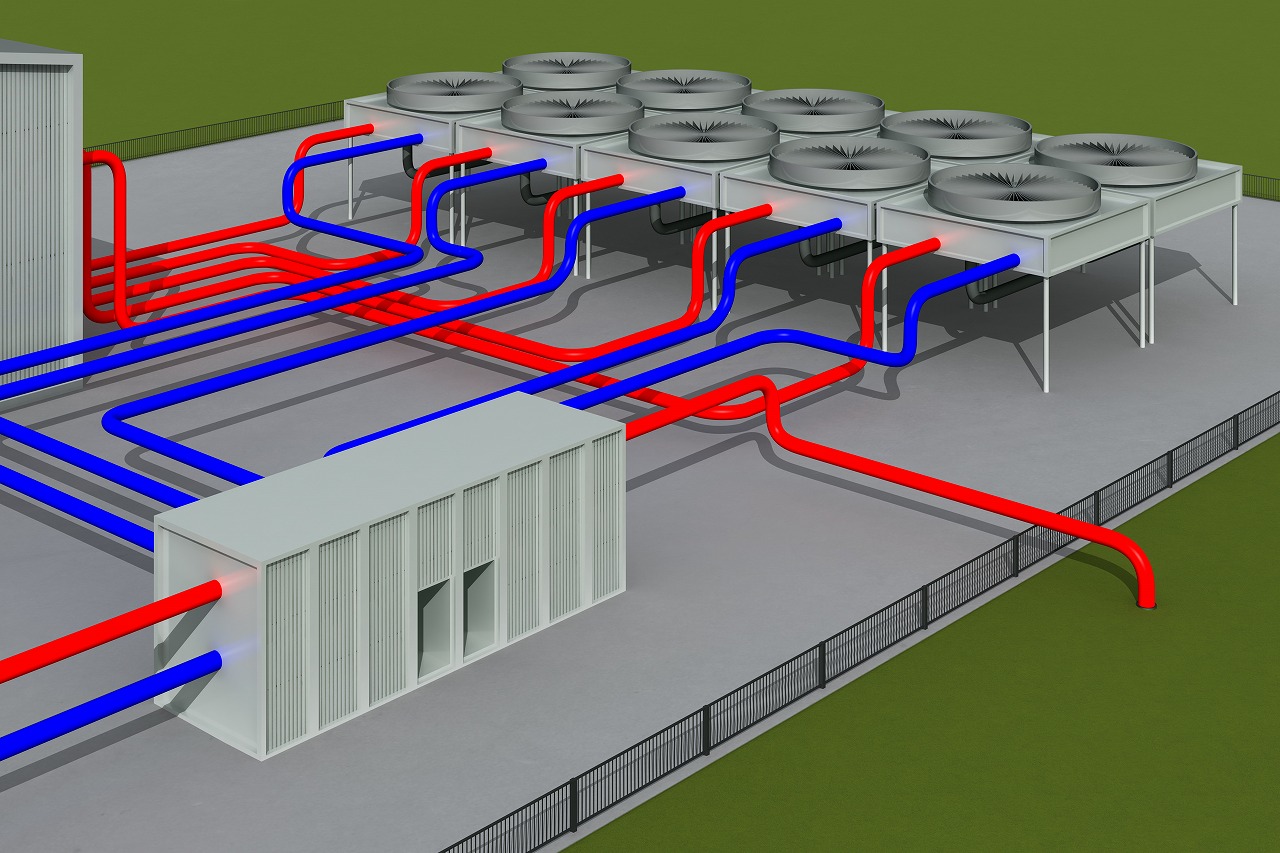

データセンターに求められるロケーション

Sorry, this entry is only available in JA.

TOPICS & NEWS

2022.09.12

JA

JA