News & Topics

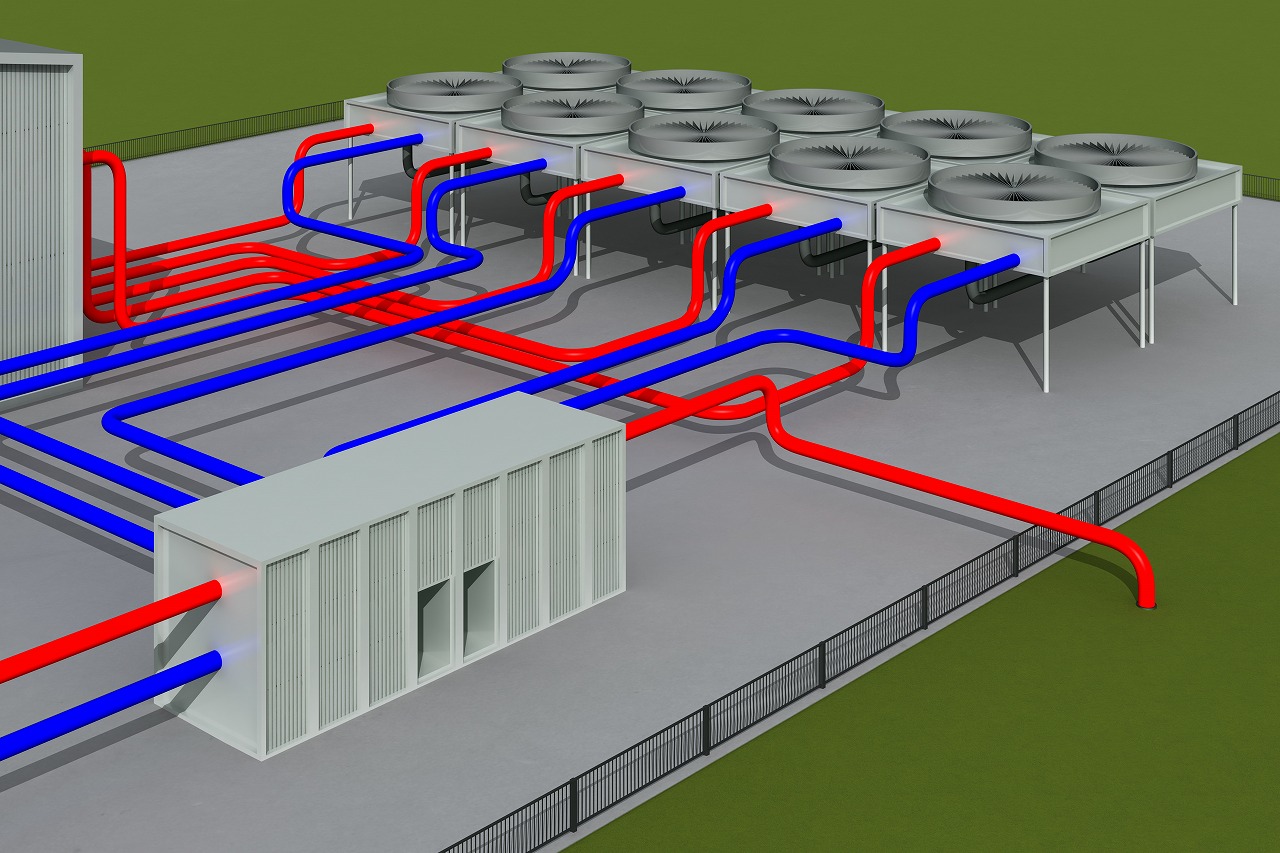

データセンターに求められるロケーション

Sorry, this entry is only available in JA.

TOPICS & NEWS

2022.09.12

(JA) その4:最終回 – データセンター(DC)とカーボンニュートラル

Sorry, this entry is only available in JA.

Founder Message

2022.09.05

(JA) その3:データセンター(DC)とカーボンニュートラル

Sorry, this entry is only available in JA.

Founder Message

2022.09.05

(JA) その2:データセンター(DC)とカーボンニュートラル

Sorry, this entry is only available in JA.

Founder Message

2022.09.05

(JA) その1:データセンター(DC)とカーボンニュートラル

Sorry, this entry is only available in JA.

Founder Message

2022.09.05

JA

JA