TOPICS & NEWS

CBRE (Japan headquarters: Marunouchi, Chiyoda-ku, Tokyo) has launched a dedicated data center page (search site) on PROPERTY SEARCH, one of the largest commercial real estate portal sites in Japan operated by CBRE, as part of its “Leasing Services for Data Center Use (search site) on PROPERTY SEARCH, the largest commercial real estate portal site operated by CBRE in Japan.

Background of the search site launch

Since the COVID 19 pandemic, demand for data centers has been increasing year by year, including server room relocations due to office space reduction, establishment of BCP bases in light of disaster and geopolitical risks, and rapid growth in demand for cloud computing due to the promotion of DX.

In Japan, data traffic is expected to double in the two years to 2021 due to the expansion of digital services, and demand for data centers is expected to further increase due to the further expansion of cloud service use. On the other hand, under the government’s policy for the development of digital social infrastructure, the decentralization of data centers, which are concentrated in large cities, is being considered, as well as the obligation to make all new data centers 30% more energy-efficient by 2030 and to partially convert electricity used in data centers to renewable energy under the “Green Growth Strategy for Carbon Neutrality by 2050”. The data center industry is now entering a new phase, as the government is considering mandating that all new data centers be 30% energy-efficient by 2030 and that some data centers use renewable energy.

In order to respond to these changes in the business environment, CBRE, in cooperation with data center operators, has collected information on data center properties with the aim of providing general business companies and other data center users with a wider choice of data centers to use, and has created Japan’s first data center We have built Japan’s first data center property search site.

Search site main service contents

We provide comprehensive and integrated support for the execution of solutions to our clients’ issues, from the formulation of real estate strategies related to data centers to development, transactions, and operations.

Their main services are as follows.

– Advisory services for “real estate strategy development” for data center business

– Brokerage for purchase, sale, and lease of land for data centers

– Appraisal” of existing data centers and “consulting” reports for new data centers

– Development project management for data center construction

– Property and facility management for data center operations

The data center industry is entering a phase of further expansion. With Corona, video distribution and online shopping have grown, and the importance of data centers as social infrastructure has further increased, making data centers a target asset for real estate investment.

Globally, telecommunications carriers and IT service companies have been aggressively investing.

The data center market in Japan is expected to grow further in the future, and foreign data center operators are entering the market one after another.

In addition to the rapid pace of data center development in Japan, which is driven by the increasing amount of investment each year, we must also respond to social issues such as the government’s initiative to promote regional decentralization and carbon neutrality, and we must strategically address data center development in a holistic manner. In addition, the government is taking the lead in the development of data centers.

CBRE’s knowledge and experience in advisory, consulting, and management of facilities such as logistics, warehouses, factories, infrastructure, and data centers, combined with CBRE’s domestic and international network and solid platform, will provide a new value-added service. Expectations are high for this new value-added service.

2022.12.10

In the past, we introduced the following three conditions for determining the location of a data center that can operate stably in Japan.

(1) elimination of communication delays and redundancy

(2) High power consumption and redundancy

(3) Measures against natural disasters

These three factors were introduced in this report.

In this issue, we will focus on what kind of locations are selected as data center sites around the world.

Data Center Location Ranking.

U.S. Overwhelmingly Popular – Northern Virginia Tops the List

Northern Virginia has once again been named the “World’s Most Attractive Data Center Locations” by real estate specialist Cushman & Wakefield in its annual ranking of the world’s most attractive data center locations.

Global Data Center Market Comparison Report Ranks U.S. Top 8 Cities.

The report ranks Internet centers according to criteria such as fiber connectivity, tax incentives, and land and power prices.

The top 10 are skewed toward the U.S., with Cushman predicting that Northern Virginia, with its current capacity of 1.7 GW, will likely reach 2 GW or more in the next two years.

It is no surprise that Northern Virginia has once again topped the overall rankings for the third year in a row.

Virginia is the largest data center market in the world and has a strong construction pipeline.

It offers excellent connectivity, attractive incentives, and low-cost power.

Vacancy rates are very low, demand is high, and operators and tenants alike are interested in expanding.

As such, the region has the potential to become the world’s first 2 gigawatt market within the next two years.

Silicon Valley and Singapore are also well known for their lack of land and power, and in the case of Singapore, they actually rank high despite the government putting the brakes on approvals to build data centers.

While high power availability is cited as an important location factor in Japan, land and power are the three lowest priorities among the 13 factors Cushman considered in its ranking.

This indicates that builders are always expected to find ways to squeeze capacity in locations that score high on the top priority of being close to the hub’s existing capacity.

Cushman’s top three factors are fiber connectivity, market size, and cloud availability.

The elements that come next are essentially optional and include sustainability, political sustainability, taxes, and incentives.

Environmental risk from natural disasters, which is considered important in Japan, is the lowest weighted factor.

Hong Kong’s very low use of renewable energy, which means that data center operators emit large amounts of greenhouse gases, moved it from outside the top 10 to sixth place in this factor.

On the other hand, Seattle and new entrant Portland tied for 10th place, both being recognized for their consideration of environmental issues, “Both are sustainability-focused cities in the Pacific Northwest of the United States.

U.S. Advantages

The data center U.S. dominance may be due to the fact that U.S. social media and cloud hyperscalers dominate the Internet.

However, this could also reflect the fact that China does not participate in the international real estate market in the same way as other countries.

Beijing and Shanghai are included on this list, but Shanghai does not top the list, despite being the fourth largest data center hub in the world at 600 MW.

The top 10 includes eight U.S. hubs, with Atlanta, Portland, and Phoenix new to the list, making up for the fall of New York (No. 9 last year). London (previously No. 7) and Amsterdam (No. 10 last year) fell out of the top 10, despite being 800 MW and 400 MW, respectively.

Outside of the U.S., Singapore, Hong Kong, and Sydney are the other three cities ranked in the top 10.

Note that 11 cities are included in the top 10 due to a tie for 10th place.

It remains to be seen how this global data center situation will affect Japan.

2022.11.25

List of Adopted Businesses

On June 27, 2022, the Ministry of Internal Affairs and Communications (MIC) announced the results of the first round of public solicitation for the “Project for Strengthening Digital Infrastructure by Distributing Data Centers, Submarine Cables, etc. in Local Areas”.

The selected businesses are as follows

|

Indirect Subsidiaries |

Location |

|

Ishikari Enedata Center No.1 LLC |

Ishikari City, Hokkaido |

|

Yahoo Japan Corporation |

Shirakawa City, Fukushima |

|

NTT Global Data Center |

Souraku-gun, Kyoto |

|

Optage Inc and KS Higashi Umeda, LLC |

Osaka City, Osaka |

|

Softbank Corporation and BBIX Corporation |

Ikoma City, Nara |

|

Internet Initiative Japan Inc. |

Matsue City, Shimane |

|

QTent Corporation |

Fukuoka City, Fukuoka |

What is the purpose of the public offering?

The Ministry of Internal Affairs and Communications (MIC) has stated that the purpose of this public offering is to support the establishment of digital infrastructure such as data centers, submarine cables, and Internet access points (IX) in Japan, where large-scale earthquakes are expected to occur, and to develop robust communication network bases through decentralization, in order to contribute to the development of a “safe and secure” data hub from the perspective of economic security and other issues. The project will contribute to the development of a data hub that can store and process domestic and international data in a “safe and secure” manner from the perspective of economic security, etc.

Local Governments Want to Attract Data Centers

Prior to this, on April 12, 2022, the Ministry of Economy, Trade and Industry (METI) published on its official website a list of sites that are open to the establishment of new data centers.

In order to optimize data center placement, we exchanged opinions with local governments that were interested in establishing new data centers, and more than 100 local governments proposed candidate sites.

What is the future of the data center business?

According to the latest forecast of the domestic data center service market by IDC Japan K.K. released in 2021, the data center market in Japan will be worth 2,798.7 billion yen in 2025, with an annual growth rate of 12.5% from 2020 to 2025. The market is expected to continue to grow on the back of demand for cloud computing.

According to the company’s survey, new data centers are expected to be built one after another for about four years starting in 2021, and the number of business data centers to be built during this period is expected to be around 200,000 square meters (equivalent to four Tokyo Domes) annually on a total floor area basis.

Keep an eye on this increasingly active data center investment.

We propose off-balancing based on our knowledge of digital infrastructure.

Investments in digital infrastructure, as typified by data centers, are extremely expensive and require a variety of information gathering, which often results in missed business opportunities due to lack of speedy decision making. To promote sustainable digital infrastructure investment in Japan, we at Digital Infrastructure Lab bring together people with practical experience in feasibility assessments, fund and asset management, construction and development, and data center operations.

We offer ESG investment proposals that benefit your company, focusing on off-balance sheet schemes based on our knowledge in the digital infrastructure area.

For more information.

https://di-lab.biz/proposed-scheme/

Quotes and references.

https://www.ciaj.or.jp/ciaj-wp/wp-content/uploads/2022/06/20220627saitaku.pdf

https://www.ciaj.or.jp/dc_inf/#inner_info

https://www.meti.go.jp/press/2022/04/20220412003/20220412003.html

https://www.idc.com/getdoc.jsp?containerId=prJPJ48272821

2022.08.09

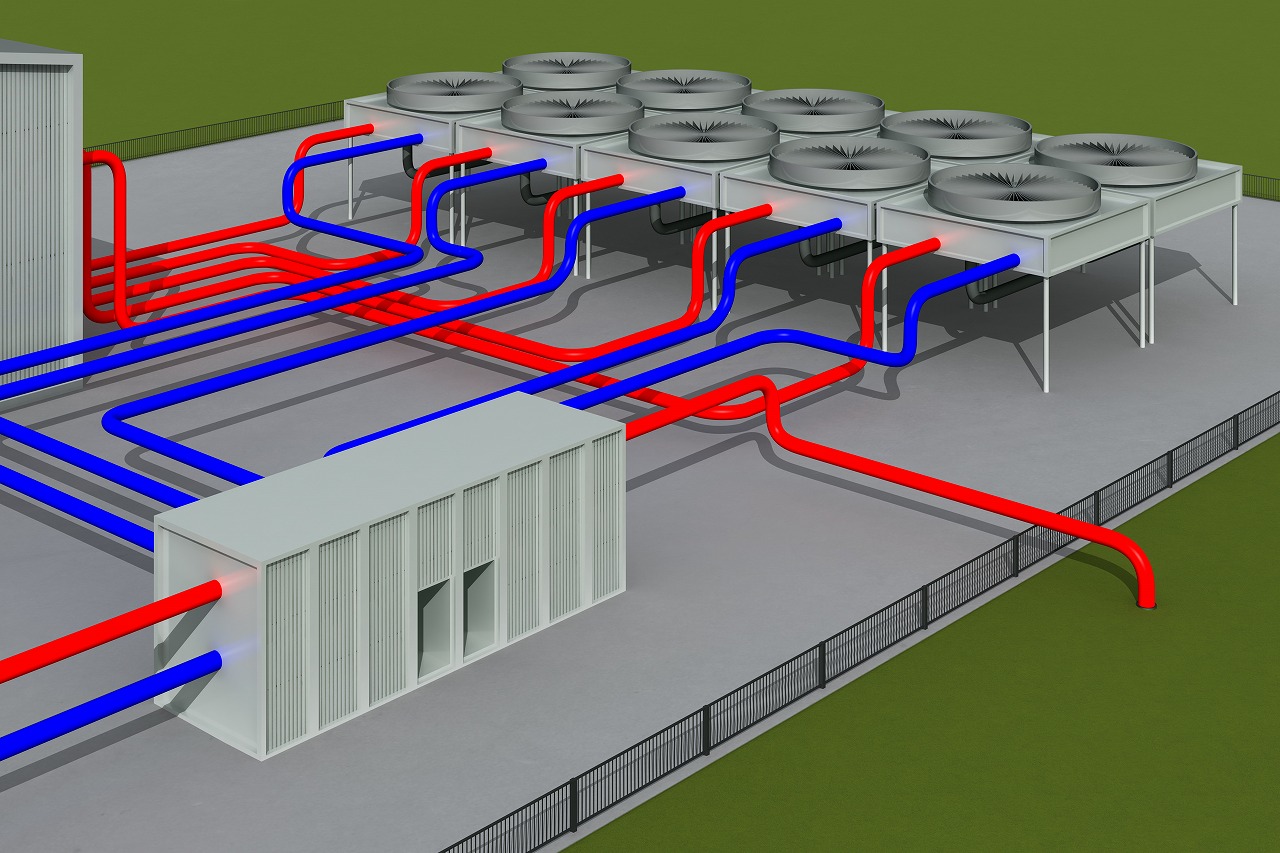

When geothermal heat utilization is mentioned, “geothermal power generation” comes to mind, and instability is pointed out.

However, since geothermal heat always maintains a constant temperature, it can also be used for heating and cooling through heat exchange.

Digital Infrastructure Lab visited Mr. Masakatsu Sasada, an authority on the use of geothermal heat (President of the Association for the Promotion of Geothermal Heat Use), to learn more about how geothermal heat is being used.

There are examples of large hospitals utilizing MW units of geothermal heat for air conditioning, and inquiries to Mr. Sasada from general contractors and others have been increasing.

We also heard about popular data center sites and areas suitable for geothermal heat utilization.

We will continue our research in order to make use of this information in our concrete proposals.

2022.06.27

JA

JA