News & Topics

List of Adopted Businesses

On June 27, 2022, the Ministry of Internal Affairs and Communications (MIC) announced the results of the first round of public solicitation for the “Project for Strengthening Digital Infrastructure by Distributing Data Centers, Submarine Cables, etc. in Local Areas”.

The selected businesses are as follows

|

Indirect Subsidiaries |

Location |

|

Ishikari Enedata Center No.1 LLC |

Ishikari City, Hokkaido |

|

Yahoo Japan Corporation |

Shirakawa City, Fukushima |

|

NTT Global Data Center |

Souraku-gun, Kyoto |

|

Optage Inc and KS Higashi Umeda, LLC |

Osaka City, Osaka |

|

Softbank Corporation and BBIX Corporation |

Ikoma City, Nara |

|

Internet Initiative Japan Inc. |

Matsue City, Shimane |

|

QTent Corporation |

Fukuoka City, Fukuoka |

What is the purpose of the public offering?

The Ministry of Internal Affairs and Communications (MIC) has stated that the purpose of this public offering is to support the establishment of digital infrastructure such as data centers, submarine cables, and Internet access points (IX) in Japan, where large-scale earthquakes are expected to occur, and to develop robust communication network bases through decentralization, in order to contribute to the development of a “safe and secure” data hub from the perspective of economic security and other issues. The project will contribute to the development of a data hub that can store and process domestic and international data in a “safe and secure” manner from the perspective of economic security, etc.

Local Governments Want to Attract Data Centers

Prior to this, on April 12, 2022, the Ministry of Economy, Trade and Industry (METI) published on its official website a list of sites that are open to the establishment of new data centers.

In order to optimize data center placement, we exchanged opinions with local governments that were interested in establishing new data centers, and more than 100 local governments proposed candidate sites.

What is the future of the data center business?

According to the latest forecast of the domestic data center service market by IDC Japan K.K. released in 2021, the data center market in Japan will be worth 2,798.7 billion yen in 2025, with an annual growth rate of 12.5% from 2020 to 2025. The market is expected to continue to grow on the back of demand for cloud computing.

According to the company’s survey, new data centers are expected to be built one after another for about four years starting in 2021, and the number of business data centers to be built during this period is expected to be around 200,000 square meters (equivalent to four Tokyo Domes) annually on a total floor area basis.

Keep an eye on this increasingly active data center investment.

We propose off-balancing based on our knowledge of digital infrastructure.

Investments in digital infrastructure, as typified by data centers, are extremely expensive and require a variety of information gathering, which often results in missed business opportunities due to lack of speedy decision making. To promote sustainable digital infrastructure investment in Japan, we at Digital Infrastructure Lab bring together people with practical experience in feasibility assessments, fund and asset management, construction and development, and data center operations.

We offer ESG investment proposals that benefit your company, focusing on off-balance sheet schemes based on our knowledge in the digital infrastructure area.

For more information.

https://di-lab.biz/proposed-scheme/

Quotes and references.

https://www.ciaj.or.jp/ciaj-wp/wp-content/uploads/2022/06/20220627saitaku.pdf

https://www.ciaj.or.jp/dc_inf/#inner_info

https://www.meti.go.jp/press/2022/04/20220412003/20220412003.html

https://www.idc.com/getdoc.jsp?containerId=prJPJ48272821

2022.08.09

When geothermal heat utilization is mentioned, “geothermal power generation” comes to mind, and instability is pointed out.

However, since geothermal heat always maintains a constant temperature, it can also be used for heating and cooling through heat exchange.

Digital Infrastructure Lab visited Mr. Masakatsu Sasada, an authority on the use of geothermal heat (President of the Association for the Promotion of Geothermal Heat Use), to learn more about how geothermal heat is being used.

There are examples of large hospitals utilizing MW units of geothermal heat for air conditioning, and inquiries to Mr. Sasada from general contractors and others have been increasing.

We also heard about popular data center sites and areas suitable for geothermal heat utilization.

We will continue our research in order to make use of this information in our concrete proposals.

2022.06.27

We are an asset management company established to promote investment in Japan for the assets in the digital infrastructure sector.

The development and acceleration of the digital & digital infrastructure mainly pulls economic growth, not only in Japan but also around the world. Meanwhile, digitalization in Japan is still lagging behind major Western and Asian countries (Japan ranks 27th in the World Digital Competitiveness Ranking 2020). It has passed more than 20 years since the beginning of 21st century. In Japan, however, we could not have big innovation because the political, administrative, economic, and social systems have never broken away from their traditional ways. I believe this is one of the reasons why we are too much behind other advanced countries in this field.

Going back to the late 1990s, Japan experienced financial crisis following the bursting of the bubble economy. At that time, Western investment funds accelerated their investment to non-performing loans and real estate in Japan, and gained a lot. Japan was able to escape from the worst-case scenario and gradually set a roadmap for the revival of the Japanese economy. Although Japan gained a chance to go to direct finance from indirect, it has not yet been able to create the huge investment funds like those of western countries, middle east countries and Singapore. I believe that one of the reasons for this is the national character of the Japanese people. Our risk-taking sensitivity differs from that of continental peoples. But what about this situation from the fast-growing companies point of view which requires huge capital investments? If it is difficult to raise funds through indirect financing. Without the risk money to the project, there is no hope for the future growth of the Japanese economy, and that would take away the opportunities from many talented people and companies that are trying to create new business.

Now we are in the new trend under the economic recovery from the Covid-19 crisis , the strong promotion of digitalization, the decarbonization, the change and diversification of people’s values, and the emphasis on SDGs and a symbiotic society.

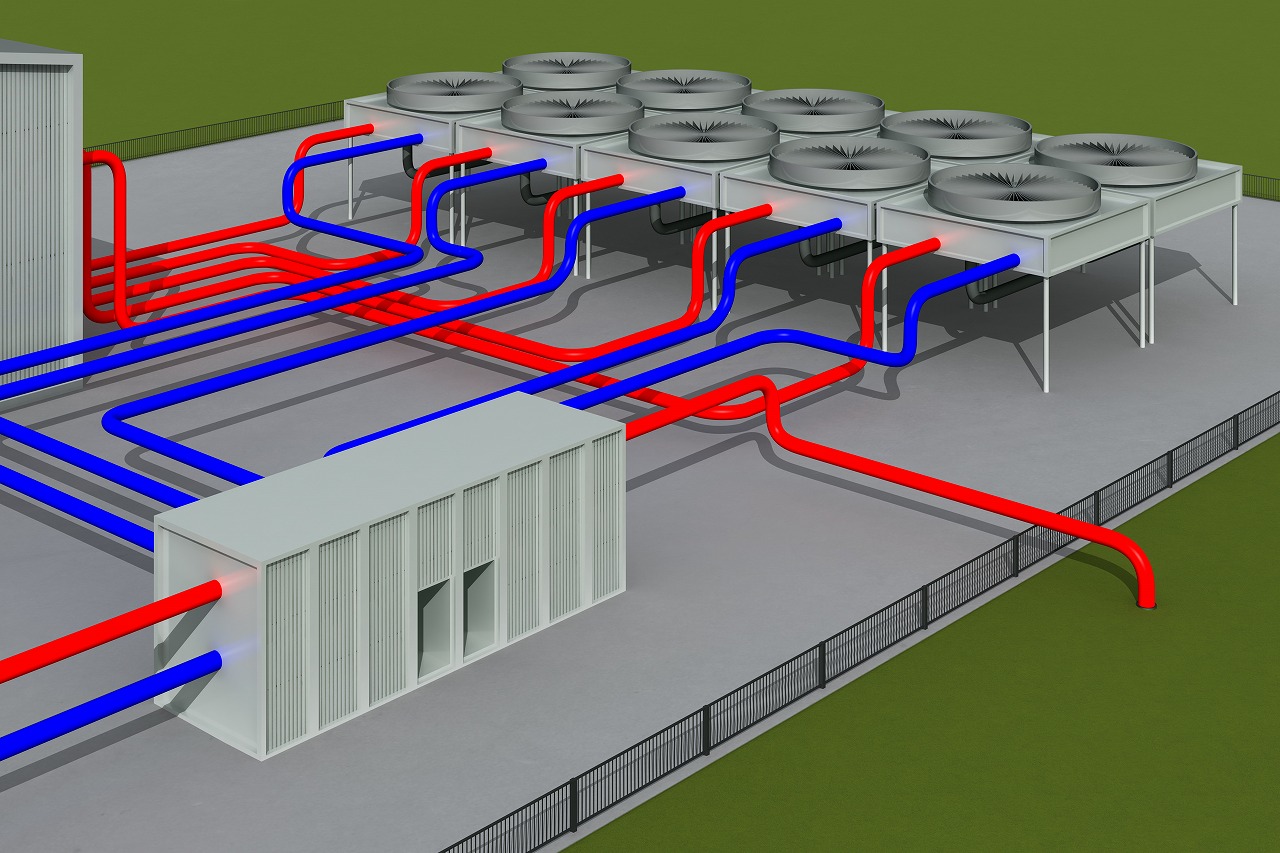

We are working for the growth and acceleration of the digital infrastructure field, which is the backbone of the promotion of the digital field. Currently, AI (Artificial Intelligence) and Deep learning are the must for digital field. However digital infrastructure has not been established yet to prepare for HPC (High Performance Computing) which is necessary for these two tech. The overall digital infrastructure, including high-performance data centers, edge data centers, and communication networks and base stations, needs to be established as soon as possible. Approximately 80% of Japanese data centers are concentrated in the Kanto and Kansai area from latency and access point of view. It is a problem from a BCP perspective. In addition more than 40% of existing data centers are more than 20 years old. Furthermore low-power data centers (2 kVA/rack or less), which cannot afford to deal with huge amount of data transaction for such as AI (these are at least 6 kVA/rack). kVA/rack or more), account for more than 60% out of all data centers. And the most important point is huge amount of money is required to establish digital infrastructure. It is said that it costs more than 3 million yen per “tsubo” for total floor space to build a new data center. Its cost is about three times as much as that of a popular office building. For example, the cost of a data center with more than 1,000 racks is 10 billion yen or more. It is not easy to decide this investment by considering the size of it. From this point of view, only a few large carriers and system integrators with strong financial background can build a data center in Japan. In order to overcome this issue, we strongly recommend the liquidation of real estate investment funds (off-balance sheet investment) with asset management services. In other words, by the separation of ownership and management, we can accelerate the investment in the digital infrastructure field. At the same time, it is necessary not only to promote investment, but also to give due consideration to the trend toward decarbonization. This means that investments in digital infrastructure must be positioned as ESG investments.

We would like to contribute to the establishment of Japanese next-generation digital infrastructure and economic development by promoting the investment to the Digital Infrastructure in Japan through our asset management service. Because we want to continue to be a essential company in digital infrastructure.

Wishing that we can make good relationship with stakeholders by getting their understanding and sympathy to our vision.

May 2022

Masayoshi Kosugi

Representative Director

Digital Infrastructure Lab, Inc.

2022.06.24

We hear that the enormous amount of power consumed by data centers have a significant impact on investment sentiment to data centers.

It is critical to realize power supply generated by a sustainable and reliable renewable energy system.

Underwater power generation has the potential to be one of the solutions to this issue.

Unlike tidal power generators, the “Kaireyu” ocean current power generation system, which is in the stage of commercialization in 10 years, is an experimental machine designed to utilize energy from ocean currents. The current for generation moves slower, but exists more widely in the ocean.

This means that we can install more generators and can get renewable power in more sites.

Ocean current power generation is much more efficient than wind power generation, and not intermittent as solar power generation. Japan is not an ideal area for solar power generation, and it is difficult to install tidal power generators because of active exercises by the navies near Japan.

This report says that these troublesome give Japanese researchers more opportunities for this project.

2022.06.06

JA

JA